I am always on the search for real estate investment properties within Edmonton, Fort Saskatchewan, Sherwood Park, St. Albert, and other surrounding areas. Every two weeks, I will be sending out an exclusive newsletter for my investor clients about potential investment opportunities in Edmonton and area. Please see below for this week’s roster of potential rental opportunities that I have found!

If you are interested in investing in real estate or would like to be the first to hear about exclusive rental opportunities, give me a call at 780 777 9703 or contact me.

1. House Rental in Fort Saskatchewan

| Price | $365,000 |

| Rent | $2,000 |

| Capitalization Rate | 4.83% |

2. Single Family with Legal Suite

| Price | $509,900 |

| Rent | $3,000 |

| Capitalization Rate | 5.31% |

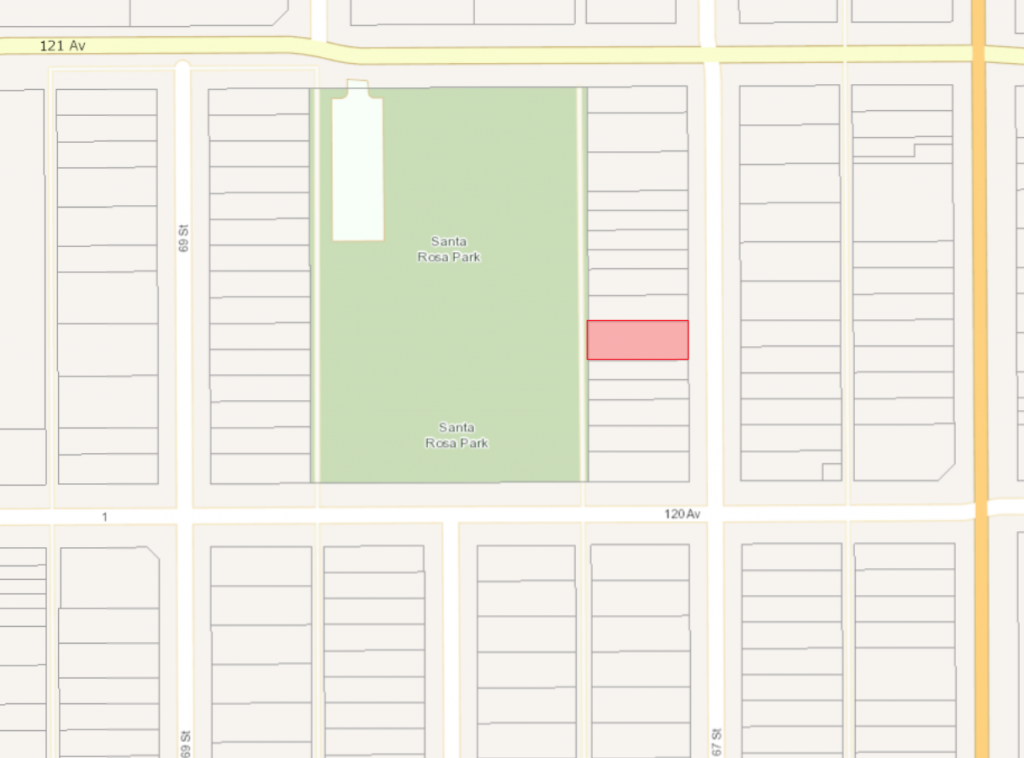

3. Great Infill Opportunity

| Price | $169,900 |

| Rent | Lot Potential |

| Capitalization Rate | Call to Inquire |

4. 15 Unit Apartment Building

| Price | $1,710,000 |

| Rent | $13,083 |

| Capitalization Rate | 5.11% |

5. Great Location and Cash Flow

| Price | $669,000 |

| Rent | $4,500 |

| Capitalization Rate | 5.56% |

6. 3 Bed + 2.5 Bath Duplex Renter Ready

| Price | $339,900 |

| Rent | $1,800 |

| Capitalization Rate | 4.60% |

Monthly Housing Statistics from Realtors Association of Edmonton

https://www.realtorsofedmonton.com/Market-Stats/Monthly-Housing-Statistics

Hire a Property Manager!

As a FULL SERVICE brokerage, Agents at Realty Executives Focus can not only assist you in buying and selling real estate but also rent out your property through our Property Management division!

Our Services Include:

- Accounting – Rent Collection and Owner Draws

- Tenant Management – Screen and Approve Applications, Tenant Turnover, Move Ins/Outs

- Owner and Tenant Communication

- Maintenance – Work Orders, Service Requests, Emergency Hotlines

- Marketing – Ads will be posted to Rentfaster, Rentals.ca, Kijiji, Zillow and more!

Invest with Us!

*Disclaimer:

There are many different factors that you should consider before investing in real estate. Every potential investor should consider their goals, current financial situation and the current market conditions.

This document provides general information only and may be subject to change at any time without notice. It does not constitute financial product advice.