Last Wednesday, I attended the 2023 Edmonton Realtors’ Association Housing Forecast at the Edmonton Convention Centre! I am so glad this event is back! It’s the first event hosted by EREA post covid. The event is a great chance to talk real estate, review historical information and learn expected projections for the new year. This year was great and informative – just as expected.

The emcee, Canadian Comedian Steve Patterson, was back for his third year (hosted both in 2019 and 2020) and did an amazing and hilarious job. The very well spoken and knowledgeable speakers included Past and Present Board Chairmans from Realtors Association, Modern Economist Todd Hirsch, Corporate Economist from the City of Edmonton and the Associate Minister of Finance, Honourable Randy Boissonnault.

I wanted to share some insight and summary of what was presented and inform you of what these experts expect for 2023! There are some variable factors and economic drivers that can potentially impact these projections that may or may not be beneficial to our market. These include climate change, global economy, military spending, conflict overseas and more.

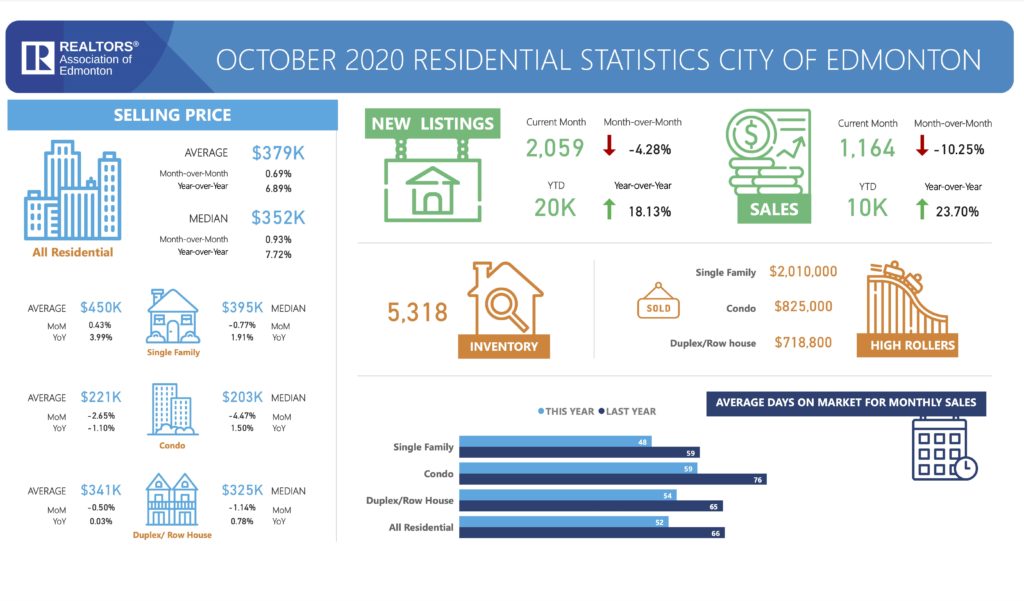

2022 Year in Review

- Average Price in 2022 for Single Family Homes: $484,822

- Total New Listings in 2022 for Single Family Homes: 21,496

- Total Sales Reported: 14,223

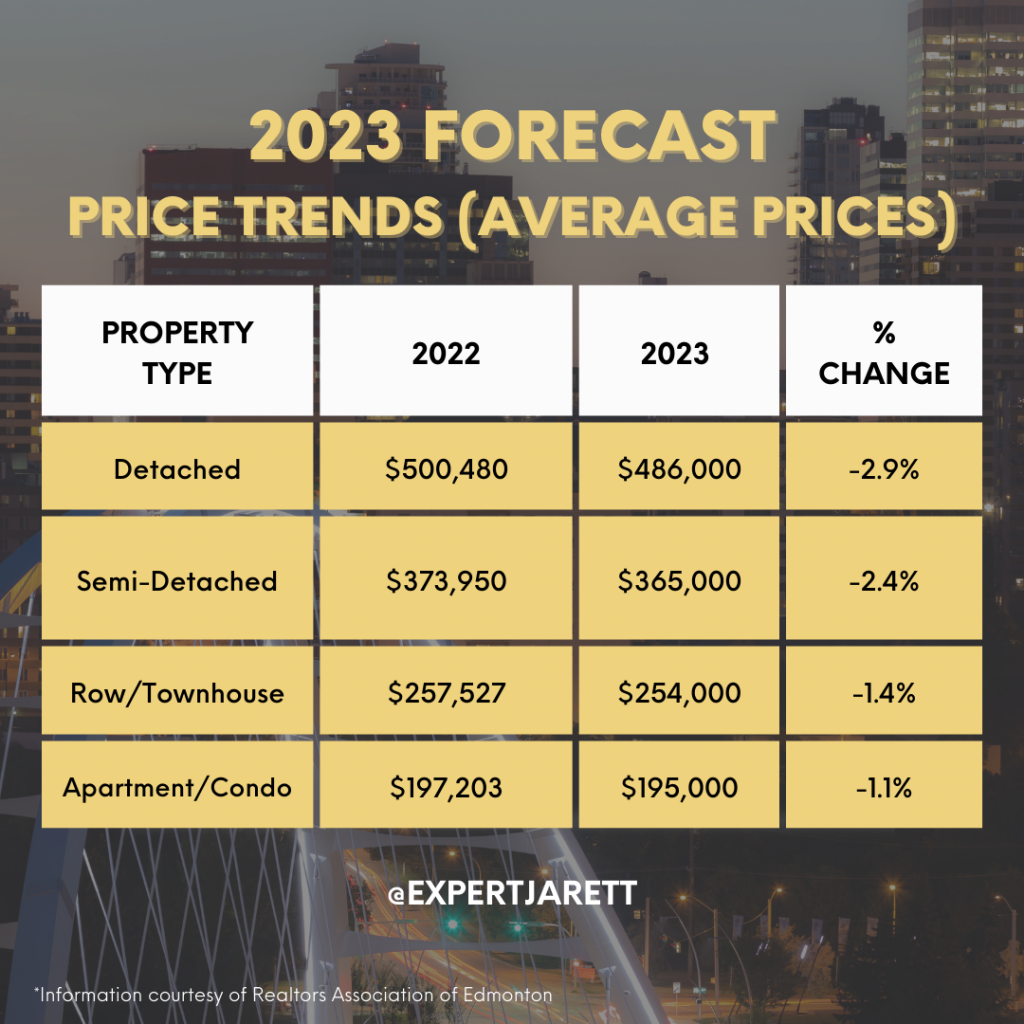

2023 Housing Market Predictions

Expect to see sales decline slightly and prices to gain modestly. Overall, the national market is expected to see more balance between buyers and sellers, a change from pandemic markets characterized by record-high buyer demand. Years 2020-2022 are considered to be anomalies and as we move forward in 2023, we can expect to see the market “correcting and normalizing” itself.

Activity in Alberta’s resale and new home markets is being supported by strong population growth. Alberta’s population grew by 1.3% in the third quarter of 2022, the highest single quarter growth rate in over 40 years.

Strong Housing Fundamentals in Alberta

Large core age population – Alberta has the youngest population in the country, with an average age of 39. More than half (53%) of Alberta’s source population is between 25 and 54 years of age, the cohort in which most household formations occur.

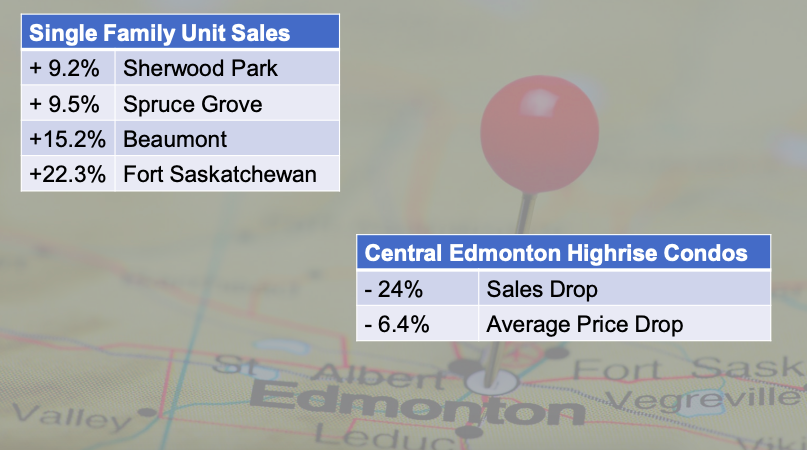

Shifting Demand/Product Type

- Increased demand for apartments/condos: Buyers aren’t going anywhere they are just looking for something different! We expect to see a shift in row/townhouses and apartments/condos!

- Continued growth in the luxury market: As I mentioned above, Alberta has a young population. A generational shift is occuring where a lot of older homes are up for sale. Investors/buyers are buying, ripping them down and building bigger homes, or renovating. We can see an increase of infills and modern homes in Edmonton!

- An influx of migration from out of province: Minister of Finance Randy Boisssault mentioned immigration. 100% of the labour force growth comes from immigrants. We can expect to see more newcomers looking and buying homes.

Key Takeaways:

- Edmonton can expect the 2023 market to continue to normalize. Compared with long-term trends, the COVID years are anomalies. This means we will see a drop in year-over-year numbers, with sales, listings and prices hovering at levels seen in 2019 and prior.

- Our region is well-positioned to take on the economic challenges 2023 could bring. Alberta has affordability, demographics, and employment on its side.

- According to a recent report from the Government of Alberta, “In Alberta today, it takes 21 weeks of work to pay the annual mortgage payments on the average home purchased on the resale market. As a result, this is 41% lower than the national average of 36 weeks. By contrast, it takes 50 weeks of earnings in BC, 46 weeks in Ontario, and 26 weeks in Quebec to meet annual mortgage payments.”

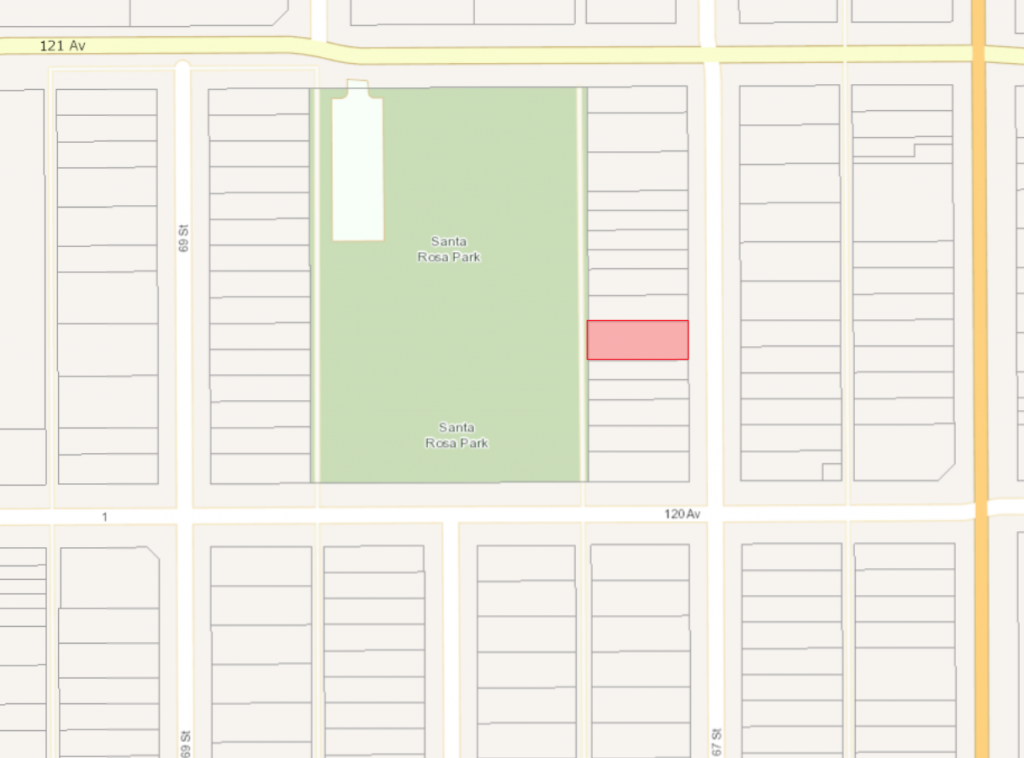

- Greater Edmonton Area – Edmonton, Fort Saskatchewan, Sherwood Park, St. Alberta and other surrounding cities are both a great place to live and invest real estate in! One of Edmonton’s continued strong activity is it remains among the more affordable markets.

If you have any further questions or would like to discuss what this means for you and your real estate investment, please do not hesitate to contact me any time!

All the best!